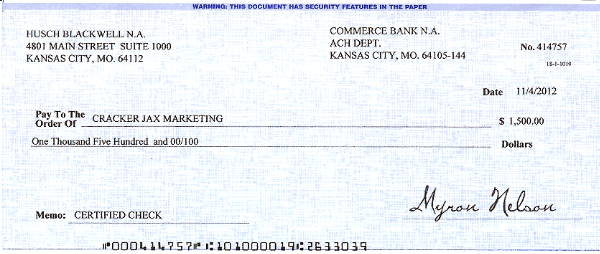

How to write a US check for $12,816.70 (USD, US dollars), in six easy steps / how to instructions How to write a US check for $4,367.70 (USD, US dollars), in six easy steps / how to instructions How to write a US check for $463.69 (USD, US dollars), in six easy steps / how to instructions How to write a US check for $440.81 (USD, US dollars), in six easy steps / how to instructions How to write a US check for $1,000.00 (USD, US dollars), in six easy steps / how to instructions How to write a US check for $160,290.00 (USD, US dollars), in six easy steps / how to instructions Snake Case can be lowercase or uppercase.

Snake Case: text has no spaces nor punctuation and the words are delimited by underscore. Hyphen Case can be lowercase or uppercase.Ĩ. Hyphen Case: text has no spaces nor punctuation and the words are delimited by hyphen. Pascal Case: See the Camel Case above, but the first letter is also capitalized. Camel Case: text has no spaces nor punctuation and first letter of each word is capitalized except for the very first letter in the series. Start Case: first letter of each word is capitalized without exception. Sentence case: only the first letter of the first word is capitalized. Title Case: first letter of each word is capitalized, except for certain short words, such as articles, conjunctions and short prepositions, 'a', 'an', 'the', 'and', 'but', 'for', 'at', 'by', 'to', 'or', 'in', etc. Example: 'seventy-six and two tenths'.Ģ: Uppercase: only uppercase letters are used. If mobile deposit is not available, you can stop by an ATM or your financial institution, and then you're done.1: Lowercase: only lowercase letters are used. Make sure to keep your check for at least five days to make sure the transaction post to your account, and then you can destroy it. Once you are finished, write mobile deposit and the date on the front of the check. It can be as simple as taking a picture of the front and back of the check. After you fill out the back of the check, simply follow the instructions on your financial institutions app. Or if available, check the box on your signature and add your financial institution's name and the date. Sign the back of your check in the designated area and write for mobile deposit at your financial institution's name below your signature. If available, you can also use your financial institution's mobile app to mobile deposit your check. To deposit your check into your account, write for deposit only and sign it. To cash your check at your financial institution, flip it over and sign the back in the designated area. You can bring the check to your financial institution to cash or you can deposit it into your account. Once you receive a check, you have a couple options.

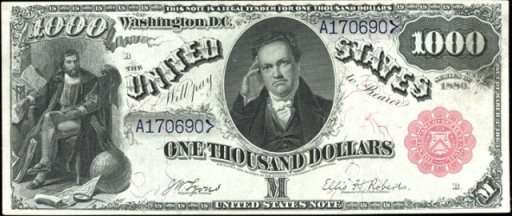

ONE THOUSAND DOLLAR CHECK PLUS

You'll need both if you plan to set up direct deposit or electronic payments, plus the check number that will show up on your account statement. On the bottom of the check, you'll see the financial institution's routing number and your account number. If you make a mistake, void the check and start again. You can also include a note for you or the payee on the memo line, or just leave it blank. Sign your name on the bottom right-hand line. If space remains, draw a line to prevent tampering. Write the dollar amount in the small box and then spell it out in the dollars line directly below the pay to the order of line. Then write the name of the person or business you're making the check out to.

First, write the date in the upper right-hand corner. Once you've written your check, we recommend either using duplicate checks (where you have a carbon copy of theĬheck you've just written) or recording the transaction in a checkbook register to track the payment when youĭid you know checks are still a relevant form of payment with billions written every year, yet not everyone knows how to write or deposit one into their account? Don't worry, we will show you. Individuals on the account, sign your name and authorize payment. In the bottom right corner, this line is where you, being one of the named This optional line is where you can make note of what the payment is for, such as Line is where you write the numerical value of payment, so in this case, "135.50". The blank line in the middle of the check is for you to write out theĪmount of dollars and cents in words, for example "One hundred thirty-five & 50/100". Payee instead of abbreviations or acronyms.

ONE THOUSAND DOLLAR CHECK FULL

As a best practice, it's always best to write out the full name of the This is where you will write the name of the person, business or Upon date when the payee is authorized to cash your check. In the upper right-hand corner, you will write the date you are making payment or the agreed Here is how you can write a check in just a few, quick steps: but it doesn't need to be! All you need is your checkbook,Ī pen and your checkbook register. Writing a check for the first time can be a challenge.

0 kommentar(er)

0 kommentar(er)